Opportunities in repurposing office stock

Bristol’s growing market for BTR and PBSA

Bristol’s growing market for BTR and PBSA

Despite serious headwinds in the office market, the overall vacancy at circa seven per cent in Bristol remains comparatively low against other major regional centres. However, such statistics hide the fact that there are elements of existing stock that are no longer fit for purpose, with refurbishment being unviable. This means that some buildings will need to be repurposed for alternative uses.

The repurposing of older office stock is nothing new in Bristol and it is estimated that around 1m sq ft of secondary office space has been removed particularly in the years following the Great Financial Crisis of 2007/2008. Alternative uses have included hotel, student accommodation and residential apartments. Some examples in the city centre include:

With low levels of vacancy, we do not have the preponderance of empty low grade office stock in Bristol City Centre that we had in the past. However, considering the growing interest in Build to Rent (BTR) and Purpose-Built Student Accommodation (PBSA), it is likely that we will witness increased investment in this sector.

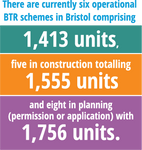

Despite economic headwinds, operational real estate sectors such as PBSA and BTR have proved to be relatively resilient. Although there was a slowdown towards the end of the year, investment volumes in both in 2022 either matched or surpassed previous highs, accounting for approximately one-fifth of all investment. This year has also started strongly for BTR with a reported £1 billion already deployed in Q1, and although Bristol has witnessed limited activity during this period, it remains a UK BTR hotspot with investments totalling c.£1 billion made in the city in recent years. One core reason that ‘beds’ sectors have proved popular with investors is that the future demand picture is easier to forecast than in other real estate sectors, as it is predominantly demographics based. While the BTR sector has primarily focused on 100 per cent newly built schemes, there are a growing number of examples of existing redundant office buildings being completely repurposed, or that have retained a large portion of the original structure. Whilst this option can throw up some operational energy efficiency issues, it generally reduces the embodied carbon of development.

So, what are the main drivers supporting BTR and PBSA in Bristol?

Rapid growth of young people in Bristol

The city has experienced rapid growth in its young population over the past decade, with the prime renter age group (25-39) increasing by c.21.5 per cent between 2012-2022 (see figure 1). In contrast, the population aged 25-39 in the UK increased by only 7.8 per cent during the same period. In 2022, this age group accounted for 28.2 per cent of the city’s population, compared to the UK average of only 20 per cent.

Record-high barriers to homeownership in Bristol

House price inflation in Bristol has outpaced wage inflation since the global financial crisis, resulting in average house prices being more than 10 times the average local yearly wages. This is higher than the UK average of around eight times. Thus, this indicates a significant barrier to home ownership and demand for properties in Bristol. Whilst renting, rather than buying will be a life-stage choice for many in the PRS, there still remain a large number of renters who will be looking to transition to home ownership. However, the difficulties they face in making this transition have an impact on rental demand. Average house prices in January 2022 in Bristol were £333,000 compared to £287,000 in England and Wales. This represents a c.93 per cent increase in Bristol since 2012, surpassing the c.67 per cent increase observed in England and Wales as a whole.

Huge growth in Bristol student numbers

The city is home to two highly ranked universities: the University of Bristol, ranked 9th in the UK (QS World University Rankings 2023) and the University of the West of England (UWE Bristol), ranked 24th (The Guardian University Guide 2023). The University of Bristol is a part of the highly regarded Russell Group, made up of 24 leading UK universities.

Collectively, these institutions accommodated a total of 59,250 full-time students in the 2021/22 academic year. This represents an impressive increase of 56.8 per cent since 2010/11 when the universities enrolled fewer than 38,000 full-time students. Among the various student categories, full-time postgraduate students experienced the most substantial growth, with an impressive increase of 132.2 per cent between 2010/11 and 2021/22. Likewise, full-time undergraduate students increased by 43.4 per cent during the same period.

Significant investments made by Bristol’s high calibre universities

The University of Bristol, for instance, is investing £350 million in its new Temple Quarter Enterprise Campus next to Temple Meads in Bristol city centre which is due to open in Q3 2026. The campus will be the base for more than 3,000 students and c.800 staff with 953 student beds. The campus will also host major new initiatives in Bristol such as MyWorld, which is a £46 million programme aimed at positioning the south west as an international pioneer in screen-based media.

Similarly, the University of the West of England (UWE) Bristol has continued to invest heavily, having spent around £300 million over recent years on buildings and facilities to attract and retain students. This includes a £55 million building to be the base for their Bristol Business School (BBS) and Bristol Law School (BLS) which opened in 2017.

International students

Not only are student numbers rapidly increasing, but there has been a shift in where students come from. In Bristol, the percentage of international students from non-EU countries has experienced a significant increase, growing from a mere 11 per cent in 2010/11 to 24 per cent in 2021/22. Thus, they have been growing at a faster rate than UK and EU students. This shift is indicative of a positive trend for the demand in Purpose-Built Student Accommodation (PBSA), as overseas students are often the primary target demographic for such housing options.

To clarify, the graph below shows that the percentage of UK students (of the total student body) is decreasing but UK student numbers are still increasing.

Currently Bristol has a high student to bed ratio of 2.6:1 compared to the national average of 2.3:1, with only 16,960 PBSA beds available. In 2021 38,605 students, or 69 per cent, were unable to access PBSA due to the lack of supply. This shows that there’s a lack of PBSA supply in Bristol and this shortfall will only enlarge the supply and demand imbalance as student numbers are forecasted to continue to grow.

Richard Coombs is a director in the UK National Investment team with particular responsibility for investment in the south west. His specialist area is business space although he also provides advice to clients across all major sectors of the market. Richard has advised clients for more than 25 years in the acquisition, sale and funding of investment property.

Lee focuses on research within the operational capital markets sector. In this role heworks closely with our key clients to create bespoke research pieces, whilst also supporting our National Capital Markets team. Lee has more than 17 years’ experience in residential and alternatives property markets, in a career that spans residential agency, management, through to research, and has worked with some of real estate’s leading market operators.

Colliers is the licensed trading name of Colliers International Property Advisers UK LLP (a limited liability partnership registered in England and Wales with registered number OC385143) and its subsidiary companies, the full list of which can be found on www.colliers.com/ukdisclaimer. Our registered office is at 95 Wigmore Street, London W1U 1FF.

This publication is the copyrighted property of Colliers and/or its licensor(s). © 2023. All rights reserved.